Money Transaction Monitoring

AML compliance involves many variables and several different fields of interest. Processes like identity verification, Onboarding KYC verification, enhanced due diligence and transaction monitoring. Financial Institutions are looking for complete compliance solutions, that’s where ABM comes in. We offer flexible solutions that help businesses with identity verification, Onboarding KYC verification, enhanced due diligence and transaction monitoring and more.

We’ve looked into the above criteria and compiled a list of the two great transaction monitoring tools that are currently in the market.

1. Comply Advantage

2. Sumsub (Sum & Substance)

Strategic Partnership

ABM has entered into strategic partnerships with COMPLY ADVANTAGE and SUMSUB to offer our esteemed clientele advanced solutions for ID Verification, Know Your Customer (KYC) processes, AML Sanction and PEP Check, Adverse Media Search, onboarding procedures, and transaction monitoring. These collaborative efforts aim to safeguard against money laundering, terrorist financing, and various other financial crime risks.

Complay Advantage

Transaction Risk

1. Transaction Monitoring:

Monitor transactions for AML risk using rules & ML algorithms like anomaly detection, ID clustering & graph analysis.

2. Fraud Detection:

Monitor transactions & events in real-time for fraud using out-of-the-box rules library & advanced AI.

3. Transaction Screening:

Boost sanctions compliance, reduce false positives and improve efficiency.

Customer Onboarding

1. Sanctions & Watchlists Screening:

Screen & monitor customers against sanctions, watchlists & PEPs; Plus advanced search & case management.

2. Adverse Media Screening:

Screen & monitor customers against negative news.

3. Know Your Business (KYB):

Verify business prospects and ensure it’s safe to do business with them.

Sumsub (Sum & Substace)

1. User Verification:

Verify users worldwide. Smooth onboarding and compliance have finally come together.

2. Business Verification:

Streamline your verification flow and welcome more companies to your business at record speeds.

3. Transaction Monitoring:

Detect suspicious activity in user transactions to stay compliant with your regulatory requirements and prevent fraud.

4. Case Management:

Set up verification flows, analyze indicators, investigate cases and create reports—all in one place

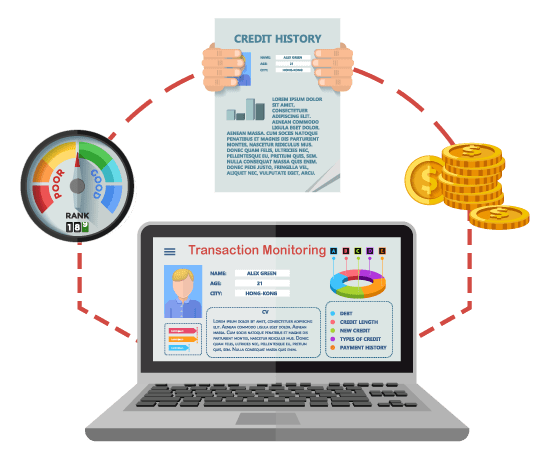

Transaction Monitoring:

Transaction monitoring is a process used by financial institutions, businesses, and government agencies to track and analyse financial transactions in real-time or retrospectively to detect and prevent illegal or suspicious activities. This monitoring is primarily focused on identifying and mitigating risks related to financial crimes.

Key features and components of transaction monitoring typically include analysis, rule-based and machine learning techniques, risk scoring, alert generation, AML and KYC compliance, data integration, and case management. By leveraging these services, organizations can effectively detect and mitigate risks associated with their financial operations while meeting regulatory obligations and maintaining the trust of customers and stakeholders.

How Does Transaction Monitoring Works?

Transaction monitoring works through a systematic process of analysing financial transactions to identify and address suspicious or illicit activities. Here are the key steps in how transaction monitoring works:

- Transaction data is collected from various sources, including banking systems, payment processors, and customer databases. Data includes transaction amounts, dates, locations, parties involved, and other relevant details.

- The collected data is integrated into a central system or platform for analysis. External data sources, such as watchlists and regulatory databases, may also be integrated for enhanced analysis.

- Static rules and predefined criteria are applied to the transaction data. Rules may include thresholds for transaction amounts, frequency, and patterns that trigger alerts.

- Machine learning models are employed to identify anomalies and patterns that may not be captured by static rules. These algorithms continuously learn from new data to improve detection accuracy.

- Each transaction is assigned a risk score based on various factors, such as transaction history, customer behaviour, and the results of rule-based and machine learning analysis. Higher-risk transactions receive greater attention.

- When a transaction is flagged as suspicious based on predefined rules or machine learning analysis, an alert is generated. Alerts contain information about the transaction and the reasons for suspicion.

- Compliance officers or analysts review the generated alerts. They conduct further investigations, which may include reviewing customer profiles and transaction history.

- Suspicious transactions are managed as cases within a dedicated system. Investigations are documented, and additional information is gathered.

- Based on the investigation results, a decision is made on whether to escalate the case, file a suspicious activity report (SAR), or take other appropriate actions.

- Comprehensive reports are generated for regulatory compliance and audit purposes. All transactions and investigative activities are thoroughly documented.

- Transaction monitoring systems continually evolve by incorporating new data, adjusting rules, and refining machine learning models. Feedback from investigations helps improve the accuracy of future alerts.

- Transaction monitoring systems assist financial institutions in meeting Anti-Money Laundering (AML) and Know Your Customer (KYC) regulatory requirements. They enable the reporting of suspicious activities to relevant authorities.

ABM offers specialized transaction monitoring software to help financial institutions and businesses in identifying and stopping financial crime.

Why Does Your Business Need Transaction Monitoring?

Although its legally required, there are several significant downsides to not doing so that warrant consideration:

1. AML Fines:

Strict regulatory requirements worldwide are in place to detect suspicious behaviour and mitigate fraud risks promptly. Non-compliance with these regulations can lead to substantial fines imposed on financial institutions.

2. Disruption of Business:

Beyond financial penalties, organizations failing to adhere to AML regulations may be compelled by law enforcement agencies to implement new processes. This can disrupt business operations as new departments may need to be established and trained, diverting resources from other core tasks. Investing in robust AML solutions from the outset is the most effective way to avoid such disruptions.

3. Loss of Reputation:

No financial institution desires involvement in a scandal, and unintentionally allowing illicit funds to flow through their operations can lead to reputational damage. Even if proven innocent, companies may continue to face scrutiny for an extended period. AML software, ensuring compliance, is the primary means to minimize the risks associated with financial crimes and protect reputation.

4. Workload:

Unnecessary tasks that could be outsourced and automated often bog down work processes. Investing in effective AML tools upfront can ultimately save a company both funds and resources. Maintaining an AML-focused department is often more expensive than partnering with external entities capable of handling these tasks efficiently.

How Can ABM Help you?

When selecting a transaction monitoring tool for your financial institution, you must be careful what transaction monitoring tool to use. ABM provides transaction monitoring software that is specifically designed to help financial institutions and businesses detect and prevent financial crimes. Here are some key features of our transaction monitoring software:

1. Real-Time Monitoring:

The software continuously monitors financial transactions in real-time, enabling quick detection of suspicious activities as they occur.

2. Rule-Based Detection:

The software employs predefined rules and criteria to flag transactions that meet specific risk thresholds or exhibit unusual patterns.

3. Machine Learning:

Advanced machine learning algorithms analyze transaction data to identify anomalies and detect emerging patterns, improving detection accuracy over time.

4. Risk Scoring:

Each transaction is assigned a risk score based on various factors, allowing institutions to prioritize high-risk transactions for further investigation.

5. Alert Generation:

Suspicious transaction alerts are automatically generated, providing compliance officers and analysts with the information needed for further review.

6. Compliance with AML and KYC Regulations:

The software ensures compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, helping organizations meet regulatory requirements.

7. Case Management:

The software includes a user-friendly case management system that streamlines the investigation process, tracks progress, and maintains a record of actions taken.

8. Reporting and Audit Trails:

Comprehensive reporting tools generate audit trails and documentation necessary for regulatory reporting and internal audits.

9. Customization:

Our software can be tailored to the specific needs and risk profiles of each organization, reducing false positives and unnecessary alerts.

Know Your Customer (KYC)

KYC – Know Your Customer is a process that financial institutions, businesses, and organizations use to verify the identity of their customers or clients. The primary purpose of KYC is to prevent fraud, money laundering, and other illegal activities by ensuring that individuals or entities are who they claim to be.

Why Is KYC Essential

- It helps organizations assess and manage the risks associated with their customers, which is crucial for preventing financial crimes.

- Many countries have strict anti-money laundering (AML) and counter-terrorism financing (CTF) regulations that require businesses to implement KYC processes.

- By verifying the identity of customers, businesses can build trust with their clients and reduce the likelihood of fraudulent activities.

- KYC helps maintain the integrity and stability of the financial system by preventing illicit funds from entering it.

ABM’s KYC Services Include

At ABM, we take pride in offering a comprehensive suite of KYC services that are designed to fortify your business’s security and ensure adherence to regulatory standards. Let us guide you through the key components of our cutting-edge KYC offerings.

1. Identity Verification:

Our KYC services kickstart with rigorous identity verification procedures. We harness advanced technology to authenticate the identity of your customers through an array of documents, including passports, driver’s licenses, and utility bills. This process is the foundation of ensuring that you are engaging with genuine and legitimate individuals or entities.

2. PEP and Sanction Check:

ABM utilizes advanced technology for comprehensive PEP screenings, identifying individuals with political influence to assess associated risks. Continuous monitoring keeps you updated on clients’ political statuses, and our PEP checks are tailored to your industry. For sanctions, we perform in-depth checks against global lists, offering real-time alerts and ensuring compliance with both local and international regulations.

3. Adverse Media Check:

Our Adverse Media Check is a critical component of our comprehensive due diligence and risk assessment services. This specialized check is designed to help you uncover potential risks and negative information associated with individuals or entities of interest.

4. Address Verification:

Our Address Verification service is a comprehensive solution designed to ensure the accuracy and legitimacy of customer addresses for businesses and organizations. ABM employs a multi-layered approach to address verification, combining various methods to confirm the validity of provided addresses. Our service utilizes document verification, database checks, and third-party resources to cross-reference and validate address details.

5. Risk Assessment:

Understanding the risk associated with your clientele is pivotal to making informed business decisions. ABM conducts in-depth risk assessments to help you pinpoint potential threats and vulnerabilities. Our proprietary risk scoring system empowers you to categorize your customers based on their risk profiles.

6. Compliance Management:

Navigating the ever-changing landscape of regulations can be daunting. ABM simplifies compliance management by keeping you abreast of the latest regulatory updates. Our KYC services are meticulously crafted to align with global and industry-specific compliance standards, guaranteeing that your business remains in compliance with the law.

7. Enhanced Due Diligence:

For customers or transactions with elevated risk factors, ABM offers enhanced due diligence services. We embark on a comprehensive investigative journey to unearth any potential red flags. This added layer of scrutiny equips you with the insights needed to mitigate risks effectively.

8. Continuous Monitoring and Alerts:

KYC is not a one-time affair; it’s an ongoing commitment. ABM provides continuous monitoring of your customer base to detect changes in their risk profiles. Real-time alerts are at your disposal, ensuring swift action in response to any suspicious activities, thereby safeguarding your business.

9. Tailored Solutions:

We understand that every business is unique, and so are its KYC requisites. ABM’s KYC services are exceptionally adaptable, catering to your specific needs. Regardless of your industry or business model, be it a financial institution, e-commerce platform, or another sector, we tailor our services to align seamlessly with your operations.

Benefits of choosing ABM

When selecting a transaction monitoring tool for your financial institution, you must be careful what transaction monitoring tool to use. ABM provides transaction monitoring software that is specifically designed to help financial institutions and businesses detect and prevent financial crimes. Here are some key features of our transaction monitoring software:

1. Enhanced Security:

Protect your business from fraud, money laundering, and other financial crimes by identifying and mitigating risks.

2. Regulatory Compliance:

Stay compliant with local and international regulations, reducing the risk of fines and legal consequences.

3. Time and Cost Savings:

Streamline your onboarding process, reduce manual efforts, and minimize the cost of compliance.

4. Improved Reputation:

Demonstrating a commitment to KYC helps build trust with customers, partners, and regulators.

The software includes a user-friendly case management system that streamlines the investigation process, tracks progress, and maintains a record of actions taken.

ABM is your partner in achieving compliance, security, and peace of mind. By leveraging our expertise and cutting-edge technology, you can safeguard your business, mitigate risks, and stay ahead of regulatory changes.