The Ultimate Guide to AML Compliance Regulation: Tips and Best Practices

Anti-Money Laundering (AML) compliance regulations are a collection of laws, rules, and guidelines designed to stop illicit revenue generation through…

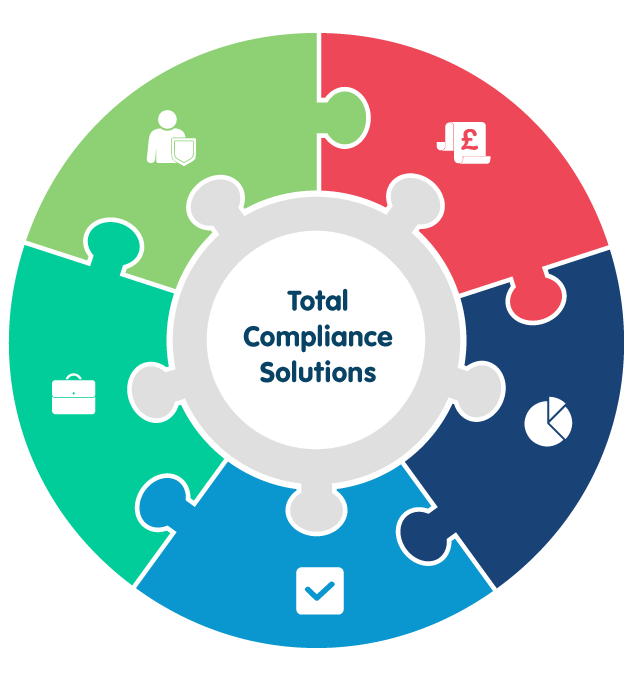

We are experienced and specialised of below key services.

Comprehensive compliance solution tailored for the financial services including Authorisation, Ongoing compliance monitoring, compliance health check.

Assist Fintech clients with comprehensive services, including KYC/AML verification tools, automated transaction monitoring, visa/master card membership, SWIFT/SEPA access.

Increase your License application authorisation chances by considering our professional advice regarding documents preparation, governance structure and controls implementation.

Provides extensive AML/CFT training programs that encompass a broad spectrum of AML regulations, offering both online and in-person training sessions.

We are experienced and specialised of below key services.

Comprehensive compliance solution tailored for the financial services including Authorisation, Ongoing compliance monitoring, compliance health check.

Assist Fintech clients with comprehensive services, including KYC/AML verification tools, automated transaction monitoring, visa/master card membership, SWIFT/SEPA access.

Increase your License application authorisation chances by considering our professional advice regarding documents preparation, governance structure and controls implementation.

Provides extensive AML/CFT training programs that encompass a broad spectrum of AML regulations, offering both online and in-person training sessions.

As a leading Consultancy Firm we offer various consulting services are ranged from Money services business, E-Money, Consumer Credit to Banks. Our Consultancy services are designed to meet the specific need of the financial service industry. In the dynamic realms of e-money and fintech, we offer innovative strategies that propel your business into the future.

Comprehensive compliance solution tailored for the financial services including Authorisation, Ongoing compliance monitoring, compliance health check.

Increase your License application authorisation chances by considering our professional advice regarding documents preparation, governance structure and controls implementation.

Comprehensive AML Compliance Audit, under FCA guidelines, reviewing AML monitoring controls, suspicious activities, safeguarding arrangements.

Ensure the business compliance with the money laundering regulations including trainings, AML controls and suspicious activity and record keeping.

Provides extensive AML/CFT training programs that encompass a broad spectrum of regulations, offering both online and in-person training sessions.

Assist Fintech clients for services encompass, KYC/AML verification tools, automated transaction monitoring, visa/master card membership, SWIFT/SEPA access.

Our 15 years of experience ABM consulting Group has grown its services for financial services from compliance consultancy to consulting services for corporate governance, Risk Management culture. Protecting the FINTECHs by implementing the KYC, AML onboarding with automated transaction monitoring tools.

Firm has taken the consultancy services to one step above and assisted the FINTECH to access SWIFT and SEPA payment schemes and become principal and associate members of Visa and MasterCard schemes.

Comprehensive compliance solution tailored for the financial services including Authorisation, Ongoing compliance, and annual compliance audit. Ongoing Compliance provides assistance against AML risk exposure which is supported by independent assurance of ABM’s annual compliance audit.

Provides extensive AML/CFT training programs that encompass a broad spectrum of regulations, offering both online and in-person training sessions. Training is designed by the professionals working in the industry by considering the recent trends and regulatory requirements.

Assist Fintech clients with comprehensive services, including KYC/AML verification tools & automated transaction monitoring (partnering ship with Comply Advantage & SUMSUB), assist the FINTECH companies to successfully secure the visa/master card membership, and full access to SWIFT & SEPA payment schemes.

ABM Global Consultancy offers assistance to UK businesses intending to issue E-Money by guiding them through the authorization process with the Financial Conduct Authority (FCA). ABM ensures compliance with Electronic Money Regulations (EMRs) and provides ongoing support for meeting regulatory requirements, including maintenance and reporting obligations. E-Money issuers must adhere to conduct rules outlined in EMRs and relevant FCA Handbook provisions.

ABM Consulting Group PLC specialised services assist the financial service providers not only successfully secure the licence but also ensure the compliance during the operations and complying with their ongoing regulatory requirements. ABM Consulting Group PLC also assists the FINTECH companies to expand its operation through payment and card schemes.

Anti-Money Laundering (AML) compliance regulations are a collection of laws, rules, and guidelines designed to stop illicit revenue generation through…

AML, which is likewise abbreviated for Anti-Money Laundering Compliance, denotes the operations and rules that financial institutions commit to follow…

Master Card for Small Business: Introduction Master Card is a leading global payment solutions provider that offers a range of…

Overview of Compliance Audits: Consequently, compliance audits are business operation essentials that ensure conformity with ethical as well as legal…

ABM Consulting Group PLC is a specialist consultancy firm that provides a wide range of financial services by offering strategic business consultancy and professional services.

© 2025 ABM Consulting Group PLC. All Rights Reserved