Mastercard

Achieving principal membership status with Mastercard empowers a company to directly handle and authorize payments made by customers through Mastercard credit and debit cards. This obviates the necessity for an intermediary payment processor and can lead to reduced transaction costs, enhanced management of the payment procedure, and the acquisition of valuable insights into customer spending behaviours through data and analytics. Furthermore, attaining principal membership signals to clients that the business is trustworthy and has satisfied Mastercard’s stringent criteria for excellence.

Direct Licensing Models

Mastercard provides a pathway for eligible Financial Institutions and non-financial partners to gain direct access to its network platform through licensing. Depending on the preferences and qualifications of the Customer, Mastercard offers two licensing models: Principal License and Affiliate License.

Principal Customer:

- Demonstrating active involvement in providing payment accounts and managing funds for customers, making them accessible upon request.

- Having direct access to a European clearing and settlement system, either by establishing direct access or by partnering with an existing participant in the system.

- Holding a license from a recognized SEPA (Single Euro Payments Area) body or being licensed within a SEPA member country.

- Acquiring a Bank Identification Code (BIC) from the SWIFT financial messaging network.

Affiliate Customer:

- Demonstrating active involvement in providing payment accounts and managing funds for customers, making them accessible upon request.

- Having direct access to a European clearing and settlement system, either by establishing direct access or by partnering with an existing participant in the system.

- Holding a license from a recognized SEPA (Single Euro Payments Area) body or being licensed within a SEPA member country.

- Acquiring a Bank Identification Code (BIC) from the SWIFT financial messaging network.

Direct Licensing Eligibility Requirements:

Mastercard upholds the security and integrity of its platform by implementing a standardized set of eligibility criteria that is applied universally to all customers participating in the global Mastercard network platform.

- For their license, the Principal Customer sponsors the license on behalf of the company.

- Experiences a streamlined onboarding and implementation process.

- Utilizes the collateral and settlement account of the Principal Customer.

- Does not possess ownership of ICA and BIN.

Through our customized card scheme application services, we can assist you in the following ways:

- Assessing the suitability of Mastercard for your specific needs.

- Estimating your initial and ongoing expenses by considering various projections.

- Providing guidance on your production needs.

- Submitting a meticulously reviewed membership application on your behalf.

- Expertly assisting you in implementing your card scheme procedures.

ABM can assist you in obtaining your own principal membership with Mastercard card scheme.

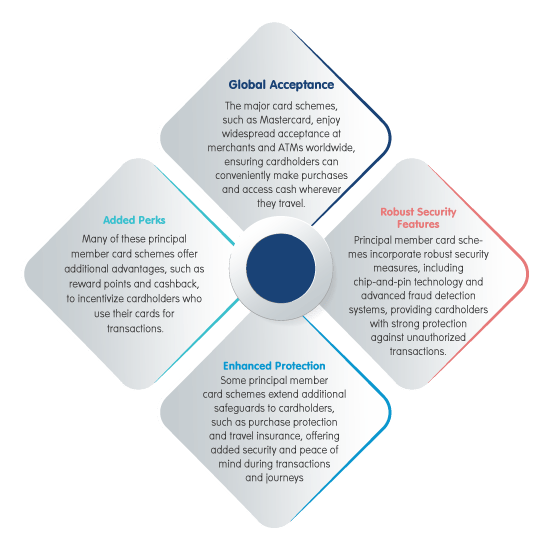

Benefits of principal member card schemes like Mastercard:

Payment and E-Money institutions must meet specific EPC (European Payments Council) requirements to become eligible for participation in any of the schemes. These requirements include:

1. Global Acceptance:

The major card schemes, such as Mastercard, enjoy widespread acceptance at merchants and ATMs worldwide, ensuring cardholders can conveniently make purchases and access cash wherever they travel.

2. Robust Security Features:

Principal member card schemes incorporate robust security measures, including chip-and-pin technology and advanced fraud detection systems, providing cardholders with strong protection against unauthorized transactions.

3. Added Perks:

Many of these principal member card schemes offer additional advantages, such as reward points and cashback, to incentivize cardholders who use their cards for transactions.

4. Enhanced Protection:

Many of these principal member card schemes offer additional advantages, such as reward points and cashback, to incentivize cardholders who use their cards for transactions.

Applying for membership in card schemes like Mastercard can be a complex and time-consuming process, often leaving individuals with more questions than solutions. It involves extensive paperwork, adjustments to corporate policies, and intricate financial assessments. We streamline this process, eliminating the hurdles and making your card scheme application stress-free and faster.

Leveraging our knowledge and expertise, we provide comprehensive guidance at every stage, guaranteeing your successful enrollment while reducing both the time and expenses involved.

ABM assistance in Mastercard Membership:

Mastercard upholds the security and integrity of its platform by implementing a standardized set of eligibility criteria that is applied universally to all customers participating in the global Mastercard network platform.

If you operate as a regulated entity with a payment institution or e-money license, ABM can assist you in obtaining your own principal membership with Mastercard card scheme. We specialize in preparing applications for card scheme memberships, regardless of your target markets. Whether you’re interested in issuing cards, acquiring them, or both, it’s crucial to collaborate with experts who have extensive experience in card scheme license consultancy.

We have cultivated strong relationships and connections to facilitate principal card scheme memberships with Mastercard. Our goal is to ensure that your issuing or acquiring business receives the necessary support and solutions to thrive, often within tight timelines. Many businesses initially start with Mastercard before exploring more specialized schemes, and ABM can assist you in determining the most suitable card scheme principals for your business and program.