About Our Company

We started our journey in 2007 from London, UK

As all businesses went through the different stages of the business line, ABM Global Compliance has also gone through the growth, expansion, peak, recession, through, recovery and again expansion. Currently company is providing the following main services for the Fin-Tech companies, Financial Institutions and Banks.

- Governance, Risk and Compliance

- Governance, Risk and Compliance

- Digital online AML/CTF Trainings and Face to Face training and certification.

- Remediation Services for Banks.

- License Application for Fin-Tech Companies, Financial Institutions and Banks

- Client Safeguarding Accounts

- Compliance Health review

- Outsource Nominated officer for the permitted jurisdictions

- Risk management software for KYC and due diligence

- Risk assessment

- Policies Controls and Procedures

Our Brief Achievements

We have successful provided solution for payment institutions license applications in the UK and Europe.

AML/CTF Training Fin-tech Companies

Satisfied Customers

Assist the business to deal with HMRC, NCA and FCA enquiries

Payment Institutions License Application

Prepare AML Controls for Business

Business Growth

Year wise our growth and initiatives

2007 - 2013

ABM Global Compliance started his journey for the professional services for financial institutions in 2007, initially the company was only providing application license assistance and on-going compliance assistance for the Small payment Institutions in the UK. Till 2013 company was more focused to the Payment institutions (Money Service Industries) including Authorised Payment Institutions and Small Payment Institutions in the UK and company has prepared complete Bespoke solutions for the payment institutions including:

- Approved License application from FCA and HMRC

- Client Safeguarding Accounts in UK and Europe

- Ongoing Compliance

- Company compliance health check

- Review of Risk Assessments and AML policy and update as per the new laws and regulations

2014 - 2018

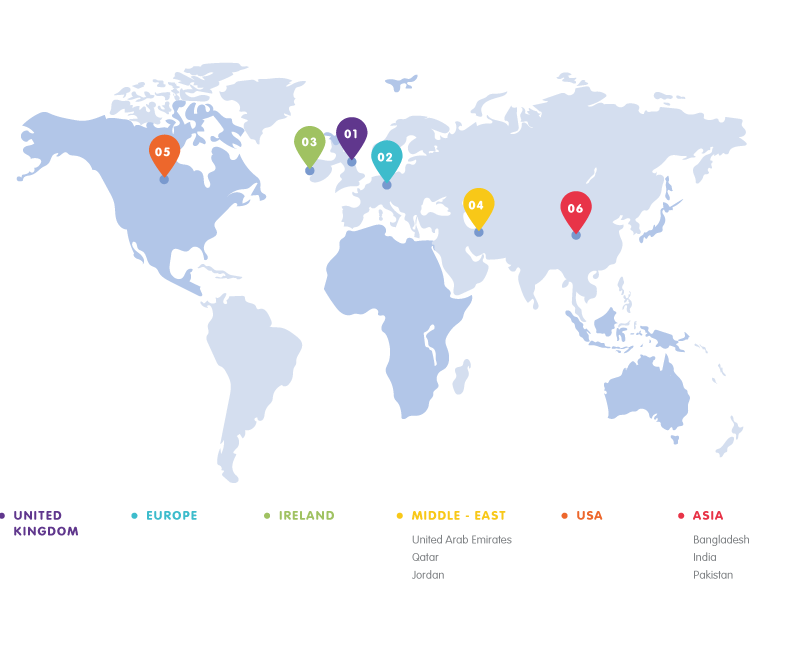

From 2014 to 2015 Company has extended its operation for the same sector in Whole Europe especially in Italy, Ireland, Germany, Spain, France, Lithuania, Estonia, and Latvia, and helps the business to generate the revenues to operate in Europe through passporting out services or having their own Payment institution licenses in Europe.

In the year 2016 to 2018 ABM has extended its operations in services and provide services for Fin-Tech companies including E-Money, Investment and Equity Funds and also expand to other jurisdictions of Middle East comprises UAE, Qatar and Jordan. Highlights for the period 2016-2018.

- Successful License Application for Electronic Money Institutions from FCA

- Remediation services for Banks

- AML / CTF and operational training Material for Electronic Money Institutions, Payment institutions and Consumer Credit

- Penetration in the Middle East for professional services for Fintech Companies

- Ensure the business viability after Brexit by getting licenses in Europe for UK Based companies

- Help Europe based companies to sustain their clients in the UK and manage to get their license from FCA

- Training Materials for Fin-Tech Companies in U.K and Europe

2019 - 2021

From 2018 to 2019 ABM was on consolidation face and ensured to strengthen its footprints in the existing markets.

From 2020 to 2021, due to COVID-19 Pandemic where the world’s way of doing work has changed, ABM adopted the same pace of change and moved to digitalization. ABM has prepared the online training platforms for the Fin-Tec companies for the United Kingdom, Europe, UAE, Qatar, Jordan, Canada, Bangladesh and Pakistan. In these two years ABM Global Compliance has expanded its services for Asian countries who are under increased monitoring of FATF.

- License application of financial institutions in Canada to FINTRAC

- AML training for financial institutions

- After Brexit explore licensed opportunities in different countries for UK based license companies

- Entrance in the United States market with local Lawyers Partnership agreement

- Re-apply for payment institutions under PSD2.

- Assist the companies in Governance and risk management.

- Digital AML training platforms of financial institutions for all jurisdictions.

- Risk Management software for KYC, due diligence of financial institution clients

- Expanding operations in Asia for Banks and Financial Institutions.

- Move business directions towards digitalization